As the Dollar Loses Ground, Gold and Silver Step Up

By Franklin Metals Group

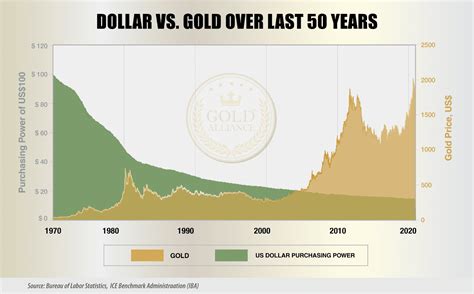

Around the globe, countries are increasingly looking for alternatives to the U.S. dollar. In financial circles, it’s known as de-dollarization—and it’s happening faster than expected.

Central banks are adjusting. In just the first quarter of 2025, they added over 244 tonnes of gold to their reserves. At the same time, the dollar’s share of global reserves is slipping—now under 47%, its lowest in decades. Gold, on the other hand, is trending upward in central bank portfolios, with gold-backed assets now accounting for close to 20% of foreign reserves in some nations.

This isn’t just geopolitical strategy. It’s monetary repositioning.

As these nations shift away from dollar dependence, physical gold is being recognized once again as a reliable, non-sovereign reserve asset. The result? Rising demand for bullion, higher prices, and a long-term floor beneath the gold market.

Silver benefits indirectly. As confidence in fiat currencies wavers, investors tend to hedge with gold first—but historically, silver follows. When money flows into metals, silver catches its own momentum, especially with rising industrial use cases in solar, tech, and energy.

For Franklin Metals Group clients, this global shift is more than a headline. It’s a moment to assess holdings, reinforce supply chains, and increase efficiency in recycling strategies. The dollar may be the world’s currency—but gold and silver are its insurance policies.

Source:

Investopedia: “Impact of De-dollarization on Gold”

investopedia.com