With the growing de-dollarization trend among BRICS nations and the overall digitization of finance, 130 countries are moving toward issuing a Central Bank Digital Currency (CBDC), which could put the US dollar at risk. Additionally, the BRICS currency, which is expected to be announced in the coming year, could only add to the international pressure on the greenback.

More Than 130 Countries Working on CBDC Development Amid BRICS Currency Creation

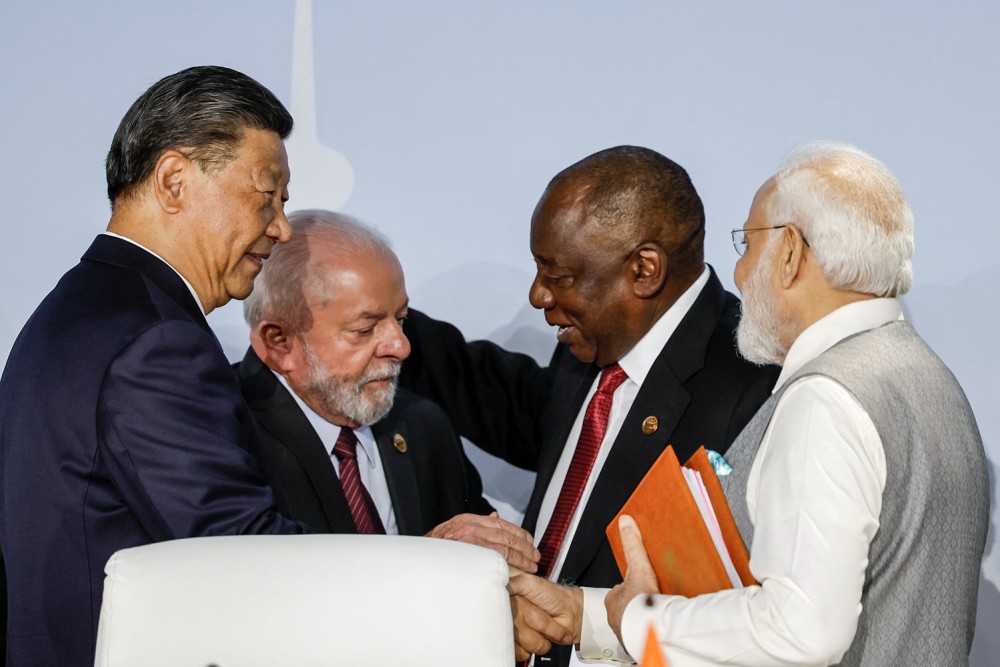

Throughout 2023, the BRICS alliance and the US dollar were major newsmakers. The former had set off significant geopolitical implications with its various de-dollarization plans. However, the BRICS alliance's projects may not be the only threat to the Western-based currency.

Research indicates that within the context of BRICS activity, 130 countries are progressing towards implementing a Central Bank Digital Currency (CBDC), posing a potential risk to the dominance of the US dollar. Additionally, this advancement coincides with ongoing efforts towards a currency project within BRICS. Speculation abounds regarding the possibility of this project also involving a digital asset utilized independently.