Silver Price Outlook – Silver Continues to Attract Buyers

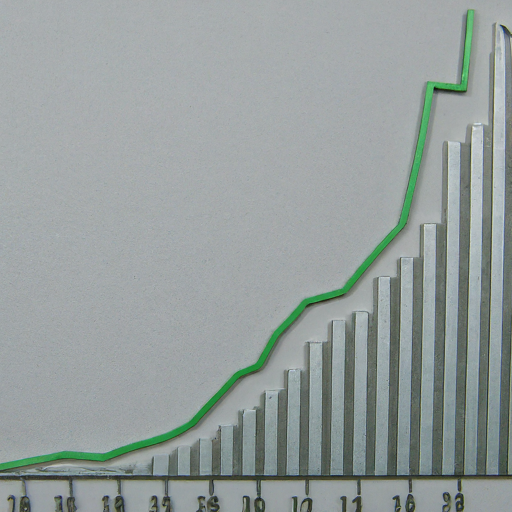

The silver market saw a significant rally on Thursday, surging towards the $28.50 level. This area has served as both support and resistance multiple times, indicating strong market memory around this price point. Adding to the significance is the 50-day EMA, which hovers just above this level. If the market manages to break through both the $28.50 level and the 50-day EMA, it could trigger a FOMO-driven surge, potentially pushing silver up to the $31.50 level.

In the short term, some back-and-forth trading is likely as both the 50-day EMA and the 200-day EMA beneath it draw considerable attention. It's also important to note that the $26.50 level has provided support in the past, contributing to the market's back-and-forth movement. This area is expected to introduce some volatility into an already volatile market.

The 61.8% Fibonacci retracement level supports this view, indicating a market that is essentially oscillating. Given this, silver is likely to remain noisy in the near term. The key question is whether the market can break above the $28.50 level, attracting more traders and fueling a strong upward momentum.