Silver Price: Stability with Potential for Growth

Silver, the versatile precious metal, has experienced fluctuating prices in recent times. However, there's potential for an upward trend in the coming months fueled by several key factors. Let's delve into the current price of silver and what the market suggests for the next three months.

Current State of Affairs

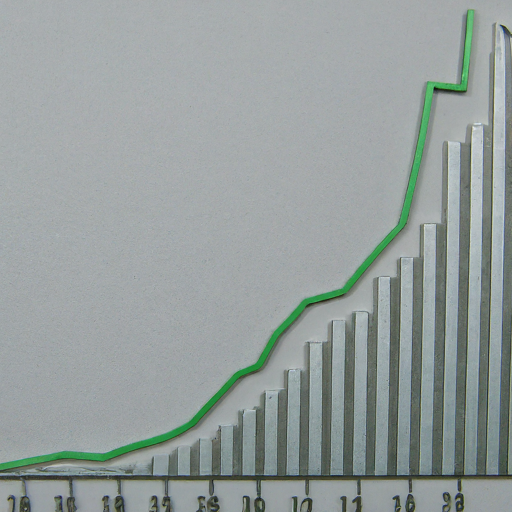

As of today [March 22nd, 2024], the price of silver hovers around $24 per troy ounce. This price reflects a period of relative stability after a surge earlier in the year. While silver hasn't reached the record highs seen in 2011, its value has consistently outperformed inflation, offering investors a safe haven.

Factors Influencing Outlook

- Weakening Dollar: A weakening US dollar tends to strengthen precious metals like silver, as they become more affordable for buyers using other currencies.

- Industrial Demand: Silver's wide usage in electronics, solar panels, and healthcare creates steady demand. Growing focus on renewable energy can drive this demand even higher.

- Geopolitical Tensions: Uncertainties in the global political landscape often push investors toward safe-haven assets like silver.

- Central Bank Policies: Potential shifts in interest rates by central banks could significantly affect silver prices. Lower interest rates may create a more favorable environment for precious metals.

3-Month Price Outlook

Considering these factors, most analysts predict a moderately bullish outlook for silver in the next three months. While dramatic surges are unlikely, a gradual price increase is a reasonable expectation. Projections for the silver price range from a conservative $25 to a more optimistic $28 per troy ounce within this timeframe.

Key Points to Consider

- Volatility: The silver market can be volatile, and prices can shift quickly in response to global events.

- Investment Strategy: Silver can be a valuable addition to a diversified investment portfolio, offering a hedge against inflation.

- Long-term Perspective: While short-term forecasts are useful, focusing on silver's long-term potential is crucial. Its industrial applications and safe-haven status provide a foundation for sustained value appreciation.

Disclaimer

Investing in precious metals carries inherent risks. This article offers information, not financial advice. Please conduct thorough research and consult with professionals before making any investment decisions.